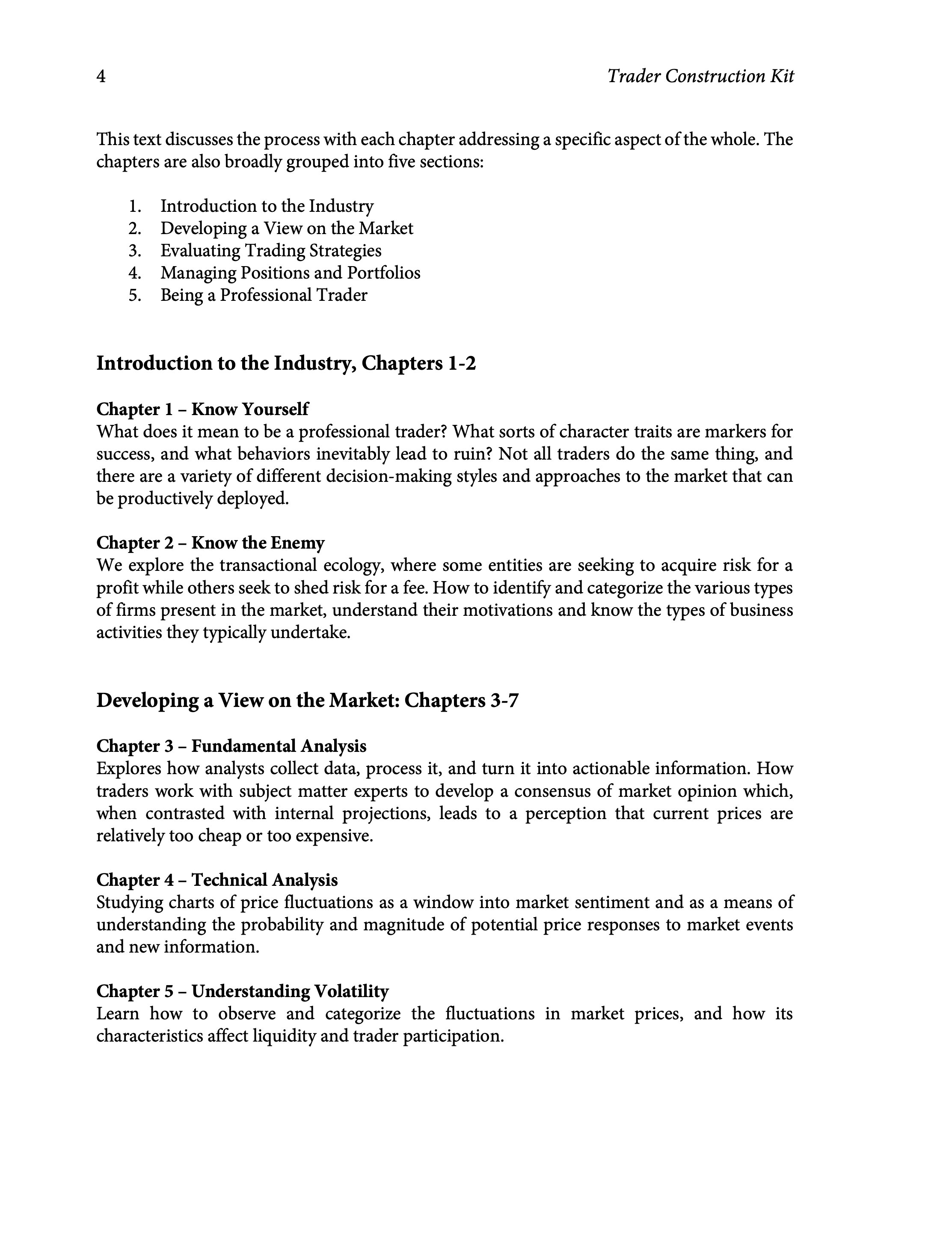

The Introduction and Chapter 1 from Trader Construction Kit discuss what it means to be a professional trader. What sorts of character traits are markers for success, and what behaviors inevitably lead to ruin? Not all traders do the same thing, and there are a variety of different decision-making styles and approaches to the market that can be productively deployed.

The Trader Construction Kit Guide - How to Get a Trading Job, published September 2018. Contains practical advice on:

1. How to prepare for a trading interview.

2. Resources for development.

3. Choosing a market.

4. Surviving the first days on the desk.

5. Transitioning to the desk from another area of the firm.

A selection of Excerpts covering some of the most popular, self-contained topics are also free to read.

The October 2017 paper on Social Science Research Network (SSRN) that compares the current academic and industry pedagogies for developing traders, which can be found at: https://ssrn.com/abstract=3057447

Abstract: There is a gap between the knowledge and skills present in graduates of top-flight finance programs and the demands of a modern trading desk. This paper compares the development methodologies common in industry and academia and proposes incremental modifications to existing finance curricula that would produce stronger graduates more able to move directly into commercial positions at financial firms. Changes to introductory finance classes, real-money portfolio management courses, and market simulation programs are discussed.

Though the paper principally addresses the academic community, it will be of interest to industry practitioners and students aspiring to a career in the markets.

Excerpts from Trader Construction Kit Copyright © 2020 Joel Rubano. All rights reserved. No part may be reproduced in any form or by any electronic or mechanical means, including information storage and retrieval systems, without permission in writing from the publisher, except by reviewers, who may quote brief passages in a review.